Receiving a grant award is a significant growth step for an organization; however, managing the grant funds appropriately is essential for a successful experience.

Understanding grant compliance requirements, regularly monitoring various aspects of the grant process, and fulfilling reporting requirements can help position your organization for success, avoid audit findings, and use funding as intended.

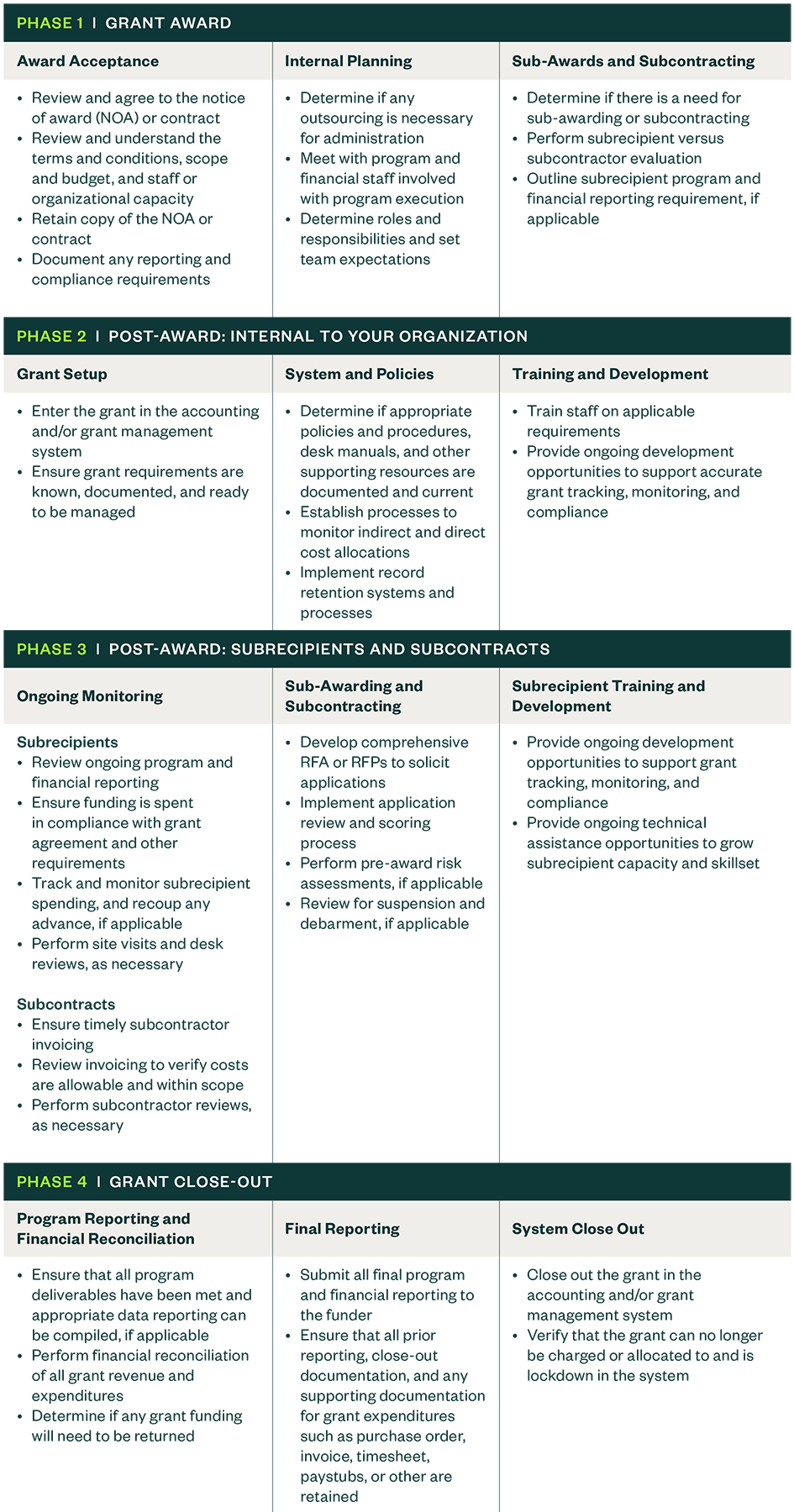

Understanding the four phases of the grant lifecycle and the steps within each phase can help organizations manage their grant effectively and facilitate compliance.

The Grant Lifecycle

There are four phases to a grant and each phase includes several steps.

- Grant award

- Post-award, internal

- Post-award, subrecipients and subcontracts

- Grant close-out

Common Grant Compliance Requirements

Compliance requirements guide the use of grant funds, expenditures, and reporting, and are used to ensure that funding is used as intended. These requirements can help establish a robust grant management and administration framework within your organization.

Adherence to proper compliance procedures ensures that both you and your subrecipients act as responsible stewards of the funding received and maintain continued eligibility for future funding.

Common grant compliance requirements include:

- Period of performance

- Specific costs and specific activities

- Eligibility

- Financial programmatic reporting

- Matching and level of effort

- Procurement

- Program income

- Suspension and debarment

- Subrecipient and subcontractor monitoring and auditing

Policies and Procedures that Support Grant Management

Compliance requirements can often lead to pitfalls and gaps in internal controls and compliance structures. Throughout the grant lifecycle, there are several policies and procedures (P&Ps) that can be developed and regularly updated to help mitigate risk.

Financial Management and Accounting

- Chart of accounts

- Journal entry preparation, approval, and posting

- Month- and year-end close

- Financial reporting and monitoring

- Budgeting

- Audit requirements

Grant Management

- Applying for funding

- Pre-award

- Post-award

- Monitoring and reporting

Procurement

- Purchase requests and thresholds required for due diligence

- Formal request for proposals (RFP) and bids

- Purchasing exceptions

- Receiving

- Vendor management

- Suspension and debarment

- Use of grant funds

Subrecipient Monitoring

- Applications

- Budgeting and expenditure monitoring

- Risk assessment and program monitoring

Common Grant Compliance Pitfalls

Complying with grant requirements can be challenging and fraught with pitfalls. Below are the most common issues auditors find when auditing use of grant funds.

Lack of Internal Controls

A lack of internal controls can be broken into three areas of focus: responsibilities, compliance, and gaps.

Responsibilities

- Does the organization’s team know and understand their role?

- Is there adequate staffing to support the grants management process?

- Does the team know what monitoring should or is happening, and whether it’s documented?

Compliance

Processes should be documented to facilitate compliance with applicable requirements, including proper tracking of and accounting for grant revenue and expenditures.

Specific focus is given to the following processes to establish internal controls that are effective:

- Grants management

- Financial accounting and reporting

- Procurement

- Contracting

- Records retention

Financial Reporting

Adequate controls should be in place, and supporting policies and procedures should be documented, to ensure that grant activity is properly tracked, accounted for, and reported.

No Centralized Storage of Records

Proper record storage is crucial for grant recipients. Storing grant-related documents and files in one centralized location allows for easy access, leading to faster decision-making and ability to locate documentation to support audits. Automating record-keeping eliminates manual tasks and helps prevent errors.

It’s important to have clear record retention policies in place to avoid any findings related to missing records and mitigate the risk of unsubstantiated or disallowed costs.

Outdated P&Ps

Having outdated P&Ps can pose significant risks for organizations, particularly those that have received a federal or other government grant. When P&Ps don’t align with current processes or systems, it can lead to confusion, inefficiencies, and even operational breakdowns. This misalignment can also result in employees following incorrect procedures leading to inconsistencies in how tasks are performed and potentially causing significant errors.

Insufficient internal controls within P&Ps can increase the risk of errors or fraud. Without clear guidelines and controls, there may be gaps that can be exploited, leading to potential financial loss or legal issues. This is particularly crucial in areas such as accounting and auditing, where precision and accuracy are critical.

Lack of Monitoring

A lack of monitoring can jeopardize future funding opportunities and increase the likelihood of unallowable costs.

Failure to monitor use of grant funds, as well as activities of subrecipients or subcontractors, can lead to inefficiencies and potential financial losses. Additionally, unmet expectations can result in missed opportunities for using grant funds effectively. These risks are further compounded by late or missing reporting.

Prioritizing monitoring activities supports compliance and maximizes the grant’s benefits.

We’re Here to Help

To learn more about how improving grant management can benefit your organization, contact your Moss Adams professional.